How to Pay & Record VAT Payments

Lots of VAT registered businesses use KashFlow, so we’ve made the process of paying and recording VAT payments streamlined and straightforward.

The majority of the work is done automatically, so it’s just a matter of clicking a few buttons to make sure the payment is recorded in your accounts.

Paying VAT in KashFlow

Submitting a VAT return automatically makes an entry into your accounts, so the amount of VAT you owe is recorded against the “VAT Control” code. This will help you to make sure that you don’t lose track of the payment.

Once you’ve submitted your VAT return, you will need to show the VAT payment in your bank account in KashFlow. This is a very simple process and is done in the same way as entering any other transaction into your bank account in KashFlow.

When to pay VAT?

You need to pay VAT at the end of every accounting period, so every 3 months. You can learn more about how to do VAT returns on this page.

Recording VAT payments in KashFlow

To record the fact you’ve made a VAT payment, just click on the Bank tab and then click “View / add transactions” next to the bank account from which you are paying HMRC.

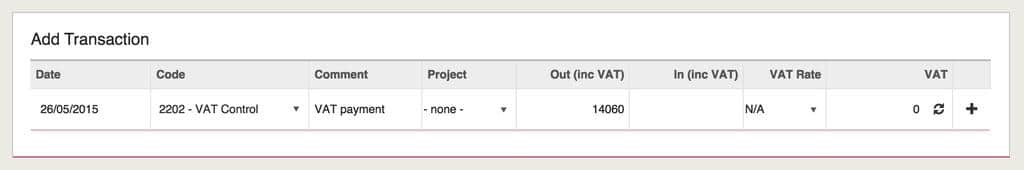

Once you’ve selected the correct bank account, it’s simply a case of adding a transaction to the account to show money going out for the relevant amount.

You can also enter any other relevant information here, like the date the VAT payment was made and other comments you may wish to make about the payment. You can learn more about what you need to include in a VAT invoice here.

When entering the payment, you should make sure to select “VAT Control” from the drop-down list for the ‘type’ of transaction.

Once all that’s done, just click ‘Enter Transaction’ and the VAT payment will be recorded in your accounts.

Which VAT records should I keep?

As a minimum, you must keep

- Copies of all invoices you’ve issued or received

- Self-billing agreements, which are VAT invoices prepared by the customer

- Debit and credit notes

- Import and export records

- Records of anything you can’t reclaim VAT on

- Records of goods you’ve given away or taken from your stock for private use

- Records of any exempt or zero-rated AVT items you’ve bought or sold.

- A register of your VAT accounts

What is a VAT Account?

A VAT account is a record of the VAT you charge and pay on your purchases. The figures in this VAT account are used in your VAT return.

VAT accounts need to include:

- Your total VAT sales and purchases

- The VAT you owe

- The VAT you can reclaim

- The VAT on EU purchases or sales

- If applicable, your Flat Rate percentage and its relevant turnover

How do I pay my VAT?

VAT is normally paid online to Her Majesty’s Revenue and Customs. This can be done via debit or credit card, Bacs, online banking or standing order, among other methods.

You can learn about the process on our page, “How to do a VAT Return“.