This Report will talk you through the VAT Return of Trading Details report.

Running the Report

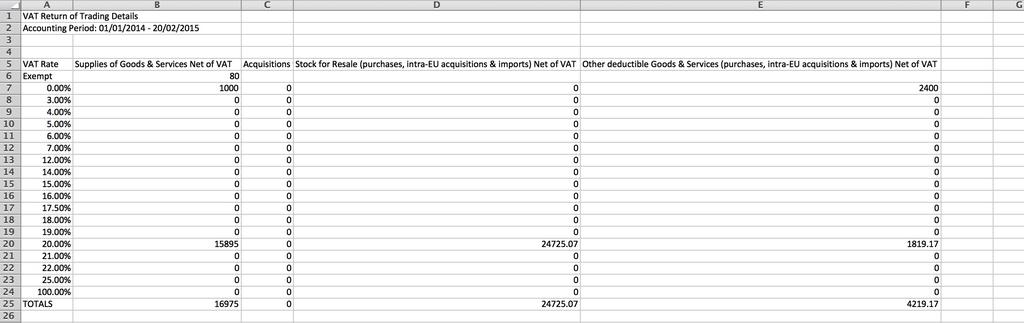

The VAT return of trading details will detail the total values of transactions that have been included in previously submitted VAT returns, sorted by VAT rate. This can be found via

Reports > General Reports > VAT Return of Trading Details.

You then select the date range you wish to see, and press Download. A CSV will then download for you.

When you open up the report CSV, this is broken down into 4 categories:

- “Suppliers of Goods & Services Net of VAT”

- “Acquisitions from EU Countries Net of VAT & VAT free imported parcels”

- “Stock for Resale (purchases, intra-EU acquisitions & imports) Net of VAT”

- “Other deductible Goods & Services (purchases, intra-EU acquisitions & imports) Net of VAT”

Your report will look something like this

You can then see the total values of the transactions that have been included in your VAT Returns broken down into the differing VAT Rates. For example “Exempt” (N/A), “0.00%”, “20.00%” and more if you have created other VAT Rates. This provides you with a broken down snapshot of your VAT figures over the specified period of time.