Please note, whilst every effort has been made to ensure this information is correct, please check with HMRC if unsure.

Income Tax

| Tax Bands rest of UK | |

| Rate | Band(£) |

| 20% | 0 – 37,700 |

| 40% | 37,701 – 150,000 |

| 45% | Over 150,000 |

| Tax Bands Wales | |

| Rate | Band(£) |

| 20% | 0 – 37,700 |

| 40% | 37,701 – 150,000 |

| 45% | Over 150,000 |

| Tax Bands Scotland | |

| Rate | Band(£) |

| 19% | 0 – 2,097 |

| 20% | 2,098 – 12,726 |

| 21% | 12,727 – 31,092 |

| 41% | 31,093 – 150,000 |

| 46% | Over 150,000 |

Tax Codes rest of UK

Emergency Tax Code – 1257L

L Suffix Uplift +7

M Suffix Uplift +8

N Suffix Uplift +6

Tax Codes Wales

Emergency Tax Code – C1257L

L Suffix Uplift +7

M Suffix Uplift +8

N Suffix Uplift +6

Tax Codes Scotland

Emergency Tax Code – S1257L

L Suffix Uplift +7

M Suffix Uplift +8

N Suffix Uplift +6

Student Loans

Threshold Plan 1 – £19,895

Threshold Plan 2 – £27,295

Threshold Plan 4 – £25,000

Rate – 9%

Postgraduate Student Loans

Threshold £21,000

Rate 6%

National Insurance

National Insurance Thresholds

Employee and employer thresholds are as follows:

2021 – 2022:

| Frequency | LEL | PT | ST | UEL | UST | AUST |

| Weekly | 120 | 184 | 170 | 967 | 967 | 967 |

| Monthly | 520 | 797 | 737 | 4189 | 4189 | 4189 |

| Annually | 6240 | 9568 | 8840 | 50270 | 50270 | 50270 |

NI Rates

Employee and Employer Rates are as follows:

| NI Rates (Employee) (%) | ||||

| Band | A, M, H | B | C | J,Z |

| < LEL | Nil | Nil | Nil | Nil |

| LEL to Threshold | 0% | 0% | Nil | 0% |

| Threshold to UEL | 12% | 5.85% | Nil | 2% |

| ST to UST/AUST | N/A | N/A | N/A | N/A |

| > UEL/UST/AUST | 2% | 2% | Nil | 2% |

| NI Rates (Employer) (%) | |||

| Band | A, B, C, J | M, Z | H |

| < LEL | Nil | Nil | Nil |

| LEL to Threshold | 0% | 0% | 0% |

| Threshold to UEL | N/A | N/A | N/A |

| ST to UST/AUST | 13.8% | 0% | 0% |

| > UEL/UST/AUST | 13.8% | 13.8% | 13.8% |

Statutory Payments (Weekly)

SAP/SMP Rate – 151.97

SPP/ShPP Rate – 151.97

SPBP Rate – 151.97

SSP Rate – 96.35

Small Employers’ Relief Threshold

£45,000

Automatic Enrolment & Pensions

Weekly Pension Rates need to be adjusted:

| Qualifying Earnings Lower Threshold | Auto-enrolment Trigger | Qualifying Earnings Upper Threshold |

| 120 | 192 | 967 |

- Monthly Pension Rates need to be adjusted:

| Qualifying Earnings Lower Threshold | Auto-enrolment Trigger | Qualifying Earnings Upper Threshold |

| 520 | 833 | 4189 |

- Annual Pension Rates are:

| Qualifying Earnings Lower Threshold | Auto-enrolment Trigger | Qualifying Earnings Upper Threshold |

| 6240 | 10000 | 50270 |

From 6 April 2019 onwards Employer Minimum Contribution is 3%, Total Minimum Contribution is 8% (Including 5% Employee Contribution)

Company Cars

Appropriate Percentage (2021/2022)

| Add 4% to a maximum of 37% for Diesel Cars, but not Diesel cars meeting RDE2 standard | ||

Cars registered from 6 April 2021

| CO2 Emissions | Electric Range (miles) | % |

| 0g/km | N/A | 1% |

| 1-50g/km | >129 | 1% |

| 1-50g/km | 70-129 | 4% |

| 1-50g/km | 40-69 | 7% |

| 1-50g/km | 30-39 | 11% |

| 1-50g/km | <30 | 13% |

| 51-54g/km | N/A | 14% |

| Each additional 5g/km | +1% | |

| Maximum | 37% | |

Note: Diesel Cars that meet Real Driving Emissions Step 2 (RDE2) regulation, are exempt from 4% Supplement i.e. same as

Electric and Petrol (%)

Cars registered on or after 1st January 1998

| Engine Size (cc) | Other (%) | Diesel (%) |

| 1400cc or less | 23 | 27 |

| 1401 to 2000cc | 34 | 37 |

| Over 2000cc | 37 | 37 |

| All rotary engines | 37 | 37 |

Cars registered before 1st January 1998

| Engine Size (cc) | Other (%) |

| 1400cc or less | 23 |

| 1401 to 2000cc | 34 |

| Over 2000cc | 37 |

Car Fuel Benefit (2021/2022)

The charge is £24,600

Current Approved Mileage Allowance Rates

| First 10,000 miles | Each subsequent mile | |

| Privately owned car | 45p | 25p |

| Bicycle rate | 20p | 20p |

| Motorcycle rate | 24p | 24p |

| Passenger rate (each) | 5p | 5p |

HMRC Advisory Fuel Rates from 1st March 2021 (pence per mile)

| Petrol | LPG | |

| 1400cc or less | 10p | 7p |

| 1401 to 2000cc | 11p | 8p |

| Over 2000cc | 17p | 12p |

| Diesel | |

| 1400cc or less | 8p |

| 1401 to 2000cc | 10p |

| Over 2000cc | 12p |

Miscellaneous

| National Minimum Wage | ||||

| Apprentice Rate (U19) | Apprentice Rate | Age 16 and 17 | Age 18 and 20 | Age 21 to 24 |

| £4.30 | £4.30 | £4.62 | £6.56 | £8.36 |

| National Living Wage | ||||

| Age 25+ | ||||

| £8.91 | ||||

| Construction Industry Scheme | |

| Registered Rate (Matched Net) | 20% |

| Unregistered Rate | 30% |

| VAT Rate | 20% |

Employment Allowance

£4,000

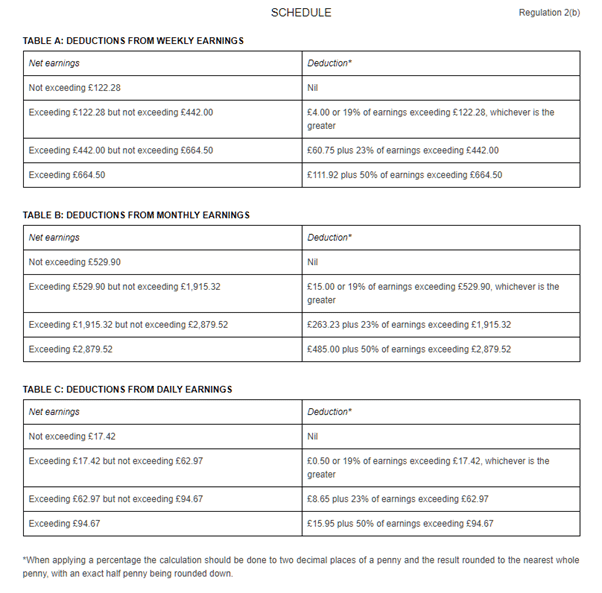

Scottish Earnings Arrestment Orders