The Balance Sheet is a hugely important report and is divided into three main segments – assets (often divided into current assets and fixed assets), liabilities, and shareholder equity or retained earnings (known as capital and reserves in KashFlow). The latter is also known as the ‘book value’, and is the difference between assets and liabilities; it represents what’s left after all of a company’s debts have been paid off. It’s also a pretty good reflection of how strong a company is financially.

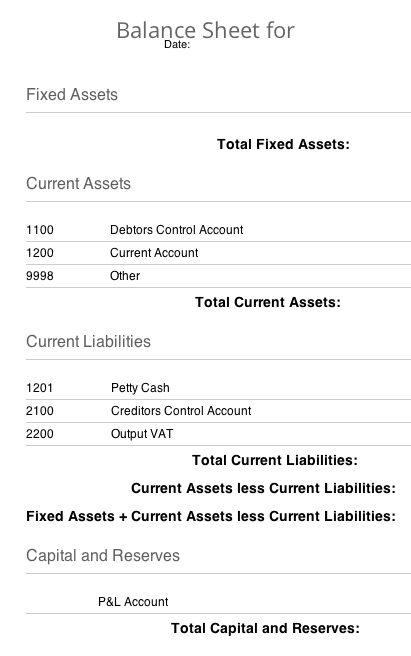

As you might expect from its name, a balance sheet has to balance. The sum of all the assets a company has must be equal to the sum of all liabilities plus capital and reserves. The format of a Balance Sheet varies – sometimes assets are placed in one column and liabilities & equity in the other – but in KashFlow, everything is shown in a single column. Here’s what a Balance Sheet looks like in KashFlow, without any numbers:

Even though the numbers are in a single column, the two figures we talked about above should still balance, i.e. Assets = Liabilities + Capital and Reserves

The Balance Sheet in KashFlow

In KashFlow, the Balance Sheet is made up of Fixed Assets, Current Assets, Current Liabilities and Capital & Reserves. Generating a Balance Sheet for a given period is as simple as running a report; entering a date will generate an on-screen report (that can also be exported as a CSV and opened in Excel) detailing your Balance Sheet.

It will display your Fixed Assets, Current Assets, Current Liabilities and Capital & Reserves. As described above, Assets (Fixed + Current) less Current Liabilities must equal your Total Capital & Reserves.

It’s possible to tweak the Chart of Accounts to reflect where they should appear in reports like the Balance Sheet and Profit & Loss. However, we don’t recommend tackling this without the help of an accounting professional…

What if my balance sheet doesn’t balance?

Don’t panic! Sometimes simple miscalculations can be responsible for a Balance Sheet that doesn’t balance. However, as above, we recommend that you speak to an accountant if your Balance Sheet doesn’t appear the way you expect it to rather trying to fix the situation yourself – you might end up making a situation that could be easily fixed worse!