Workplace Pensions

Are you Auto Enrolment ready?

What is auto enrolment?

Automatic enrolment has been introduced by the UK government to ensure all employers comply with the workplace pensions laws.

All UK employers are legally required to a provide a pension scheme, which they must contribute towards, for their employees by 2018.

This means as a business owner you need to enrol your staff into a scheme and make contributions, starting from your staging date.

KashFlow Payroll makes complying simple with a complete, online auto enrolment solution.

Try it for free or call 0330 057 4204

Start your trialWho is affected?

If you are an employer you must enrol all workers who:

- are aged between 22 and the State Pension age

- earn at least £10,000 a year

- work in the UK

You must make an employer’s contribution to the pension scheme for those workers. Click here to read more about your responsibilities as an employer.

If you are an employee and already enrolled in a workplace pension scheme, then you won’t see any changes. But if your employer doesn’t contribute to your pension, they have to start after they enrol their staff. Click here to find out more about how much you and your employer should be contributing.

What is the deadline?

Each business has a deadline to start complying with the laws (known as a ‘staging date’) and this date depends on how many people you have on your payroll. You can find out your staging date here.

If you fail to comply, The Pensions Regulator can take enforcement measures, including issuing penalty notices. These are a fixed penalty notice of £400 and a daily fine of up to £10,000 depending on the number of staff you have. They can also issue a civil penalty for cases where you fail to pay contributions due. This is a financial penalty of up to £5,000 for individuals and up to £50,000 for organisations. Click here to read more about these enforcement measures.

How to prepare

The Pensions Regulator is urging businesses to start planning for auto enrolment at least 12 months before their staging date. Here are KashFlow’s 8 steps for developing your auto enrolment Plan:

Step 1 - Find out your staging date and who you need to enrol.

Step 2 - Understand your responsibilities as an employer.

Step 3 - Consider choosing a payroll software provider that is auto enrolment ready.

Step 4 - Seek advice on workplace pensions and choose a pension provider.

Step 5 - Begin employee communications and learn how to avoid auto enrolment fines.

Step 6 - Learn how to streamline your auto enrolment process.

Step 7 - Take advice from companies that have already staged and refine your auto enrolment plan.

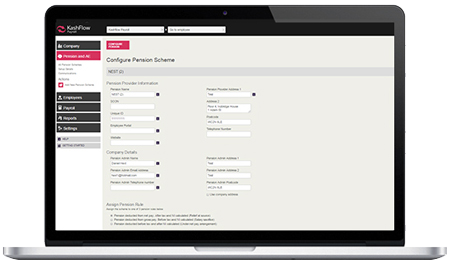

Step 8 - Configure and test your auto enrolment software.

How KashFlow Payroll can help

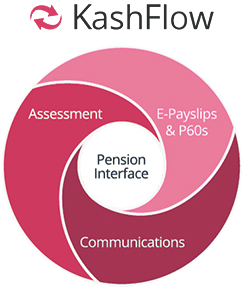

KashFlow Payroll offers a complete, end-to-end solution for auto enrolment. This includes:

- Pension scheme setup wizard including postponement and deferrals

- Automated assessment within each payroll run, enrolling eligible employees and calculating contributions

- Communications automatically generated for each employee

- Output files generated for chosen pension provider(s)

The KashFlow Payroll auto enrolment solution makes complying with workplace pensions laws easy. Download your free guide: "7 auto enrolment top tips for businesses staging in 2016".

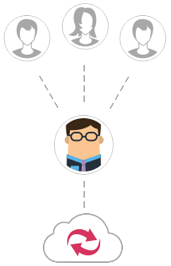

Are you an Accountant?

Provide reliable auto enrolment compliance services to your clients by using KashFlow Payroll as a bureau.

By using KashFlow Payroll as a bureau accountants can unlock efficiencies within their payroll function including integration with individual client KashFlow accounts, automated RTI submissions across all companies and automatic online payslip delivery included within a unique accountants pricing structure.

Auto Enrolment Hub