Can you be employed and self-employed?

If you’ve got an idea for a business, but aren’t in a position to fully invest your time and energy into it just yet, then you’re in luck – as you can be employed and self-employed at the same time!

Not only is it possible, it’ll be easy for you if you follow the steps in this guide. Here’s how you can work the 5 to 9 on your passion project.

Registering as self-employed and employed at the same time

If you want to run your own business, then you’ll be responsible for declaring and paying your own tax. As such, you’ll need to register with HM Revenue & Customs.

- If you’re going to be a sole trader, you can register with HM Revenue & Customs here.

- If you’re going to be a limited company, you can register with Companies House directly, with an accountant, or with an agent. Companies House will then tell HM Revenue & Customs that your company is active.

- If you’re going to employ others, or pay yourself a salary from the company, then you’ll need to register as an employer and again let HMRC know that you’ll be filing Self-Assessment as a director.

Learn more about registering as self-employed here and about registering your business here.

Can you be employed and self-employed? The tax implications

Once you’re self-employed, you’ll have to fill in a tax return that includes all of your income – including the money you earn from your regular employment.

There’ll be forms and pages for the salary you receive from your employment, plus any benefits or expenses you receive. There’ll also be forms for you to complete based on your self-employed income. If you have more than one business venture, you’ll have to fill in the self-employment pages for each business you own.

If you’re operating as a limited company, then you’ll have to complete employment pages covering the salary your company pays you, alongside any benefits your receive and expenses your business reimburses to you.

You might get a second tax code

If your business is run as a limited company, which pays you a salary, then you’ll get a second tax code for this income. This probably won’t affect your employment allowance, which is usually reflected on your first tax code (from the job you are currently employed in).

If you’re a sole trader, then you’ll pay tax on your business profits rather than on your wages, so the tax code your employer uses will remain the same.

You’ll pay extra in National Insurance Contributions

As you’re employed, you’ll already Class 1 Employee’s NICs on your wages. These are deducted from your salary, alongside income tax, usually in a PAYE (Pay As You Earn) scheme.

If you’re running your own business as a sole trader, then:

- You’ll pay a flat rate of Class 2 NICs, unless you earn under the limit of £6,025 a year in which case you can be exempt. If you’re paying Class 1 in your employed job, then your exemption shouldn’t affect your entitlement to benefits like the State Pension.

- You’ll also have to pay Class 4 NICs on profits your business makes. If you pay enough Class 1 NICs, then you can apply to defer these self-employed NICs.

If you’re running a limited company, then you’ll pay Class 1 NICs on your wages from that company, just as you would in your other employed job, once you’ve passed the primary threshold of £157 per week.

Learn more about tax and National Insurance for the self-employed here.

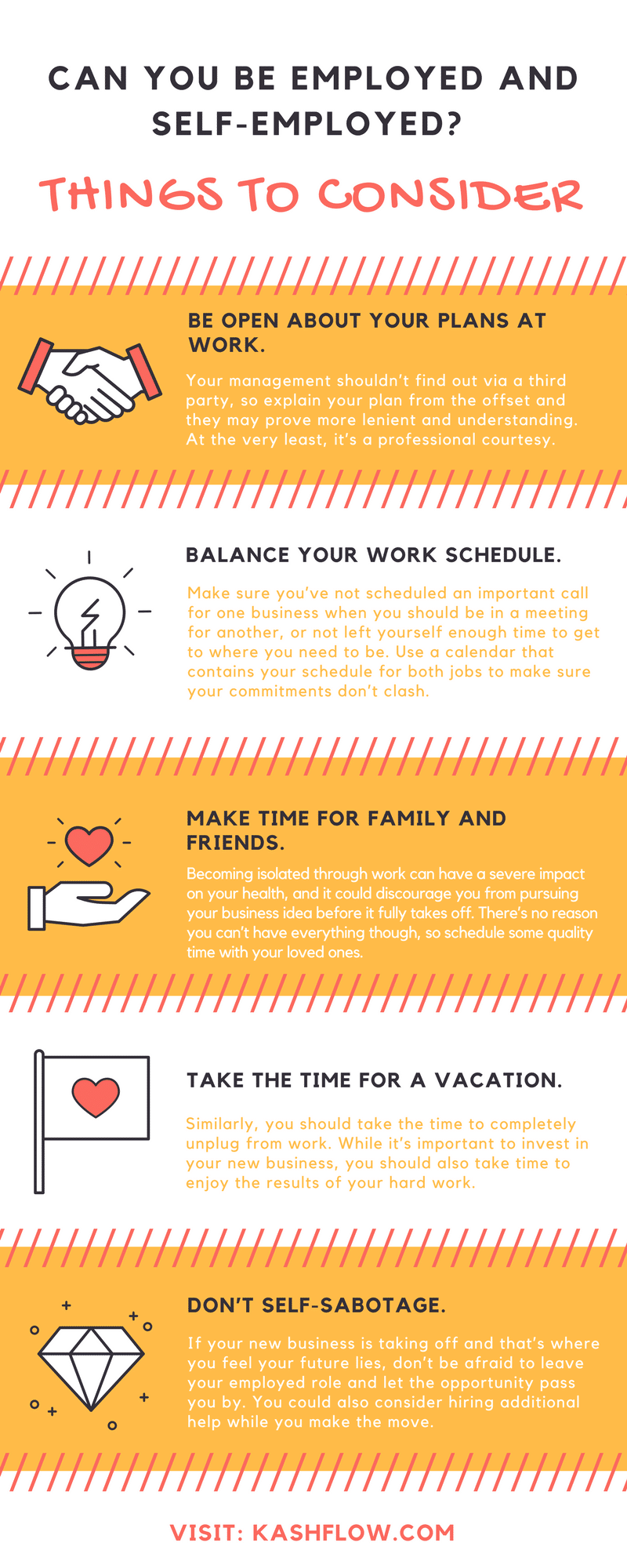

Can you be employed and self-employed? Things to consider

Beyond tax, you have a lot to consider when starting a new business alongside a regular job. Here’s some tips and things to consider:

Be open about your plans at work. Your management shouldn’t find out via a third party, so explain your plan from the offset and they may prove more lenient and understanding. At the very least, it’s a professional courtesy.

Be open about your plans at work. Your management shouldn’t find out via a third party, so explain your plan from the offset and they may prove more lenient and understanding. At the very least, it’s a professional courtesy.

Balance your work schedule. Make sure you’ve not scheduled an important call for one business when you should be in a meeting for another, or not left yourself enough time to get to where you need to be. Use a calendar that contains your schedule for both jobs to make sure your commitments don’t clash.

Make time to eat. If you’re working evenings and lunchbreaks, then you’re leaving yourself less time to cook and eat properly. Plan and make meals in advance, so you’re not spending all your hard-earned money on meals out.

Make time for family and friends. Becoming isolated through work can have a severe impact on your health, and it could discourage you from pursuing your business idea before it fully takes off. There’s no reason you can’t have everything though, so schedule some quality time with your loved ones.

Take the time for a vacation. Similarly, you should take the time to completely unplug from work. While it’s important to invest in your new business, you should also take time to enjoy the results of your hard work.

Don’t self-sabotage. If your new business is taking off and that’s where you feel your future lies, don’t be afraid to leave your employed role and let the opportunity pass you by. You could also consider hiring additional help while you make the move.

It’s easy to consider your new business a passion project that you do in your free time. While this may be the case, you should also remember it’s ultimately another job and treat it as such by not sacrificing too much for it. With balance and proper planning, there’s no reason you can’t have it all.

Going Self-Employed?

We’ve got your back. KashFlow Accounting Software is designed to make bookkeeping and accounting easy, so you can concentrate on the bigger picture of your business and keep your all-important numbers at your finger tips and easy to understand. To try a free demo, call our team on 0800 133 7529 or jump straight in and try it yourself with a free trial