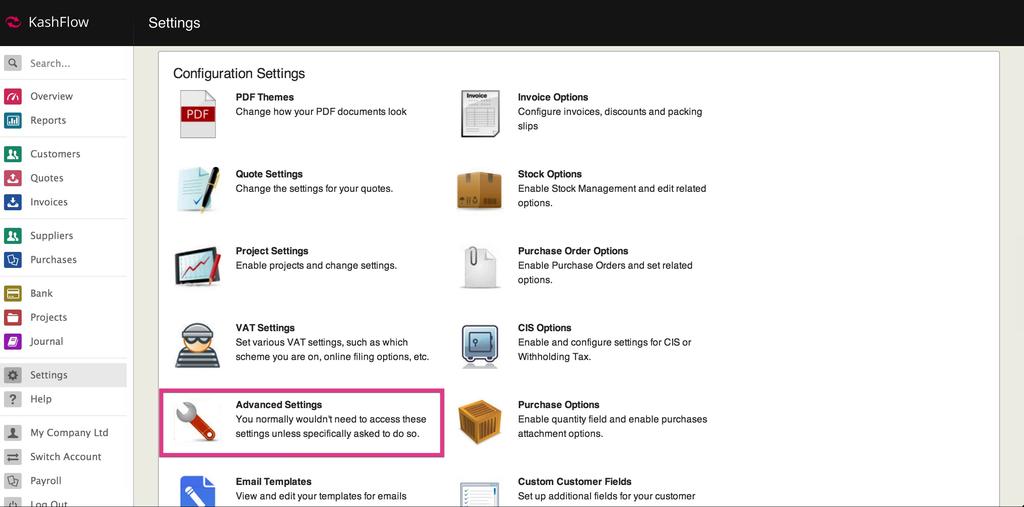

This guidance explains what each of the advanced settings options does. Access this page by going to Settings > Advanced Settings. These should normally be used with caution, as some options will affect your reports.

- Start page – Use this drop down to select what page to go to when you first log into

- Transaction Locking – Use this option to enable global transaction locking. Global transaction locking will lock all transactions including invoices, purchases and payments on and before the date set from being modified or deleted.

- Invoice Filename Format – Set how invoices are named when they are exported.

- Allow me to set the Invoice Filename format on a per-customer basis – Tick this option if you want to have different file name format for different customers.

- Prevent me from re-using a Supplier Reference twice for the same supplier – Ticking this option will compare the supplier reference that you enter with previously entered receipts. If there is already a receipt in KashFlow with that supplier reference then you won’t be able to enter in the receipt and will be alerted that is a duplicate.

- Include the customers postcode wherever customers are shown in a list – Choose to display postcodes in lists or not.

- New Bank Rec – Tick to use the new back rec method. It is not recommended to un-tick this option.

- Bank Reconciliation – Tick this option to exclude older un-reconciled items.

- Advanced VAT Settings – Use this option to hide transactions from before the date set from appearing on your VAT return.

- Tick the box to switch it on

- Enter the date that you’ve previously submitted VAT until. This should normally be the end date of your last submitted return.

- Use the cash accounting box to decide if you should include paid items from before the date or not

- Ticking the cash accounting box will mean that items issued before the VAT reconciliation date but after will not be included. For example;VAT rec date 15/01/2013. Invoice raised 01/01/2012, paid 01/02/2013 – this will not be included in the next return.

- Un-ticking the cash accounting box will mean that transactions raised before the VAT reconciliation date and paid after will be included on your next return.VAT rec date 15/01/2013. Invoice raised 01/01/2012, paid 01/02/2013 – this will be included in the

- FRS N/A Turnover – By default this box is un-ticked all your turnover (even turnover that has a VAT N/A rate set) is included in your VAT return. To only include items that you’ve classed as VATable (0% and above) tick this.

- EC Sales – Ticking this box allows you to set at a sales type level what items to appear on the EC Sales List. Normally the EC sales list is generated based on the customers EC status defined in the customer profile, however ticking this box will generate the list based on the customers EC status defined in the customer profile and if the sales type is set to be included in the sales type settings.