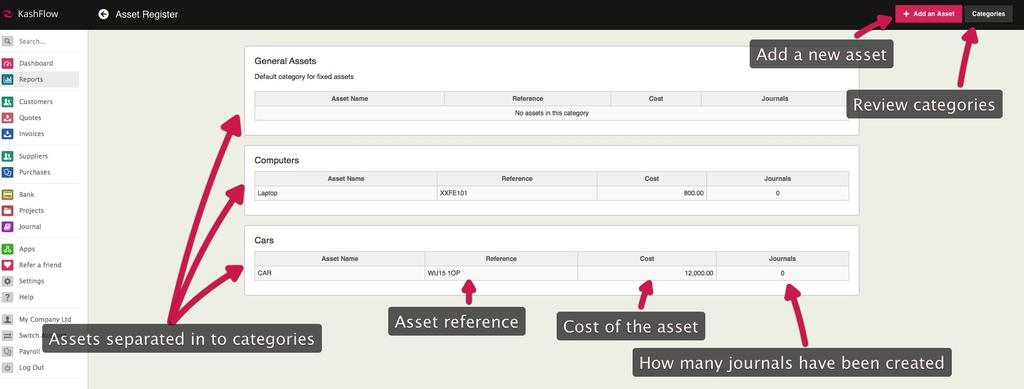

The Asset register report allows you to manage your assets through KashFlow.

You can access the tool by going in to Reports > General Report > Asset Register. Once here you will see any existing assets separated by categories.

Creating an asset

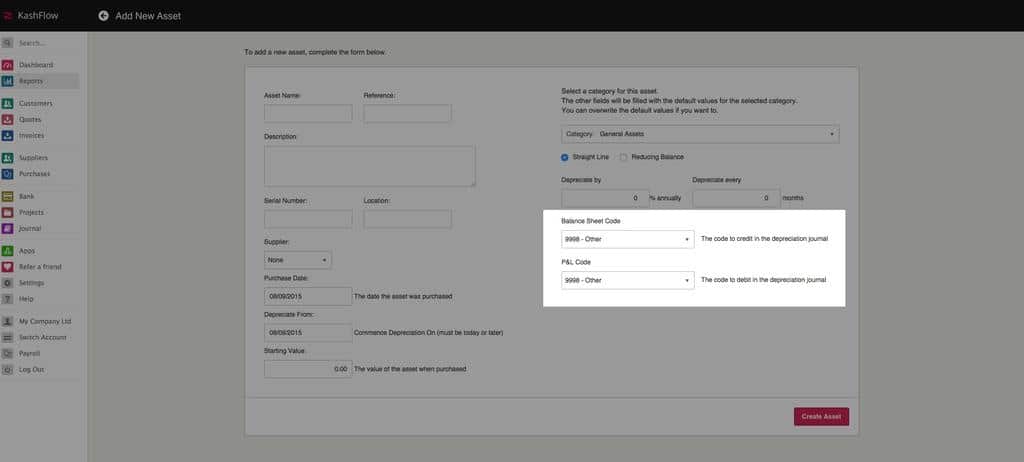

When creating an asset you will need to enter as much information as you can regarding the asset such as a reference, serial number and the purchase date. The only mandatory field is “Asset Name”.

Depreciating an asset

KashFlow can only handle future depreciation of an asset. If you’re looking to retrospectively depreciate a asset you will need to create a manual journal to the respective codes chosen for the asset.

Currently KashFlow can only deal with monthly depreciation of an asset. If you’re looking for weekly then this will need to be done through a manual journal.

Straight Line Depreciation

Straight line depreciation method charges cost evenly throughout the useful life of a fixed asset. This depreciation method is appropriate where economic benefits from an asset are expected to be realised evenly over its useful life.

Reducing Balance

Reducing Balance Method charges depreciation at a higher rate in the earlier years of an asset. The amount of depreciation reduces as the life of the asset progresses. The perfect example is a car. If you purchase a car then in 5 years the car wouldn’t be the same value when you first bought it, therefore would have depreciated in value.

Once you’ve selected the type of depreciation then you will need to enter when KashFlow can start to depreciate your asset. You can find this under the Depreciate From option. The date you enter here will need to be in the future. If you enter a past date then KashFlow will not create your depreciation journals.

KashFlow will start to create journals one month from the date you enter, so if you enter 01/01/2015 then KashFlow will start depreciating on 01/02/2015.

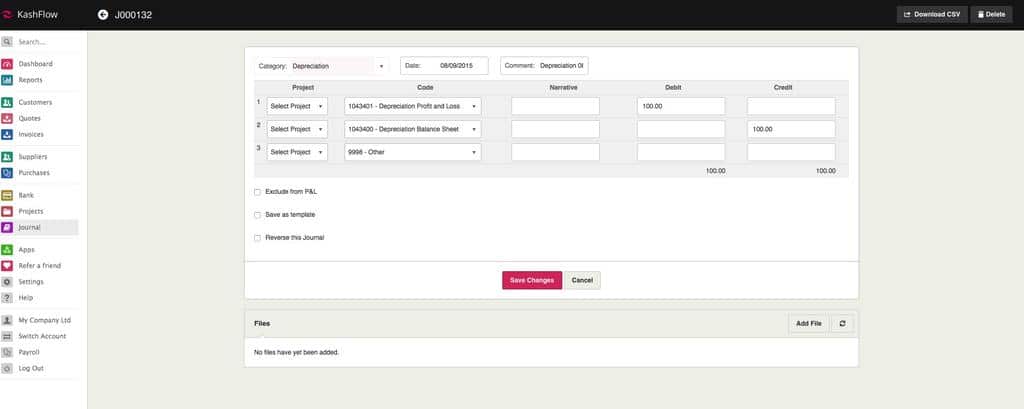

Depreciation Journal

When your journal is created automatically, it will look something like this: