To access your chart of accounts go to Settings > Chart of Accounts. This is where all your accounts and nominal code settings are set and maintained.

The settings here impact how your reports are calculated; these include your primary financial reports such as your Profit & Loss, Balance Sheet and Trial Balance. Your chart of accounts shouldn’t be modified without the advice of your accountant.

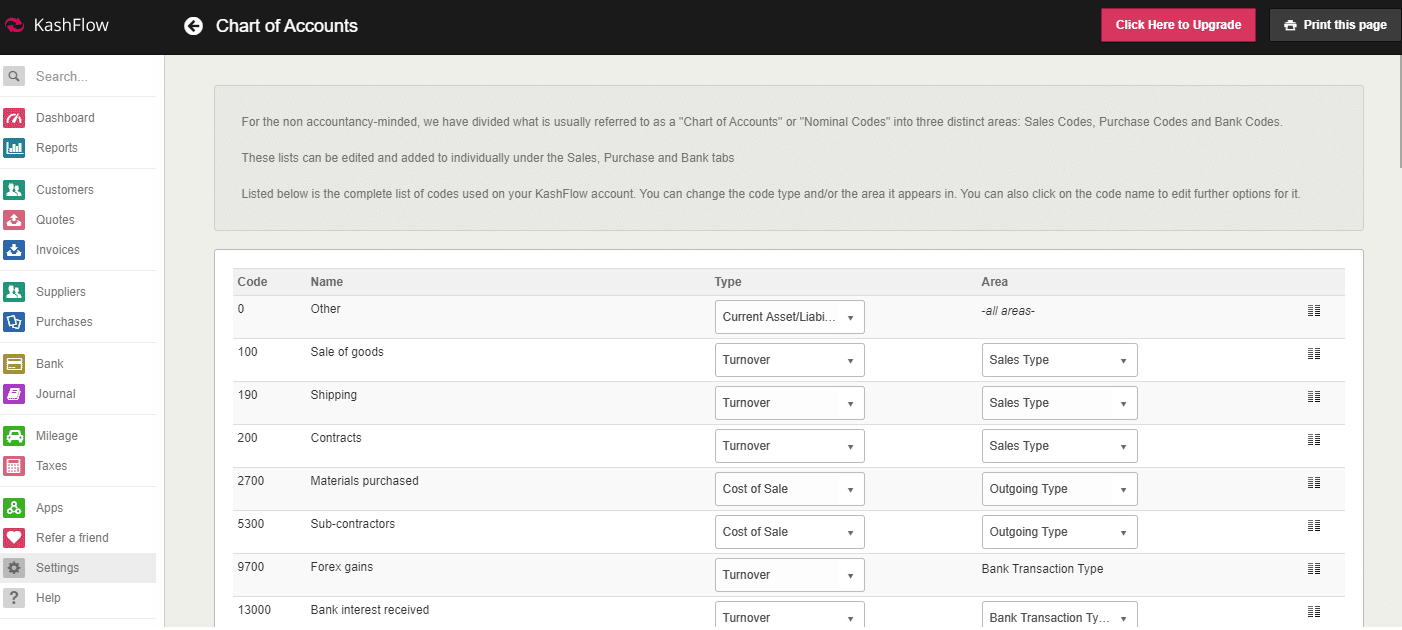

Chart of Accounts Details

Your chart of accounts is split into 4 columns;

- Code – This is the nominal code for this account.

- Name – This is the label for the nominal code

- Type – This is where the balance of the account will appear on your profit and loss report and balance sheet. Please note that if you’re unsure what you should treat a nominal code as you should contact your accountant.

- Area – This is where the nominal code will show within your KashFlow account when inputting data.

Type -Profit and Loss codes

- Turnover – this is money taken by a business and is treated as revenue. This is usually used for sale.

- Cost of Sale – this is money spent (overheads) on generating revenue. A good example could include a wholesale price of product that you will resell.

- Expenditure – compared to cost of sales, this is operational or administrative expenditure.

Type -Balance Sheet Codes

- Fixed Asset – this is an asset that cannot be easily converted into cash. Examples would include property, vehicles, cash registers and so on.

- Current Asset/Liability – This means that the account should be treated as a current and variable asset when the balance is a positive, and as a debt (known as a liability) when the balance is negative. This is normally used for bank accounts. When your bank balance is positive it’s an asset, however when you’re overdrawn you’re in debt and it’s a liability.

- Capital & Reserves – Capital is the money shareholders have contributed to the company. Reserves are the profits earned and other resources received by the company that have been kept for the benefit of shareholders.

Area

This is where this nominal code can be used. By default, the nominal code will be restricted for use in this area only unless Settings > Chart of Accounts> Show advanced configuration options > Access to Nominal Codes is enabled.

- Sales Type – This nominal code can only be used in the Sales area on invoices.

- Outgoing Type – This nominal code can only be used in the Purchases area on purchase receipts.

- Bank Transaction Type – This nominal code can only be used in the bank area on bank transactions.