The government announced a 3-month deferment in Valued Added Tax (VAT) payments for all UK businesses. Consequently, there is no requirement to make a VAT payment from 20 March 2020 until 30 June 2020. Taxpayers will be given until the end of the 2020/21 tax year to pay any liabilities that have accumulated during the deferral period. VAT refunds and reclaims will be paid by the government as normal.

The chancellor also announced that the self-employed who have Income Tax Self-Assessment, payments due on the 31 July 2020 will have until the 31 January 2021 to make their payments.

It does not cover VAT MOSS payments.

HMRC will not charge interest or penalties on any amount deferred as a result of the Chancellor’s announcement.

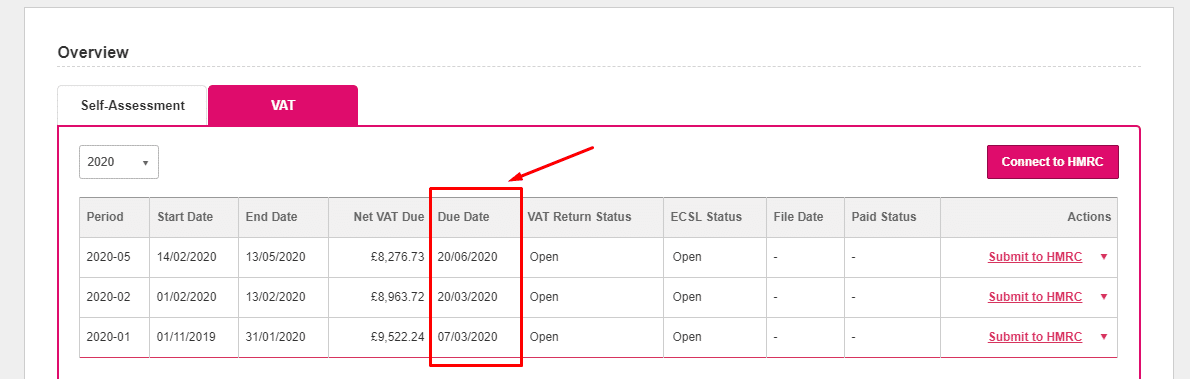

You will still need to submit your VAT Returns with KashFlow to HMRC on time as per the “Due Date” as found on the Taxes tab within KashFlow.

For more information regarding the Deferral of VAT payments, please visit the HMRC website by clicking on this link.

Here at IRIS, we are also keeping our customers informed by the latest changes in government legislation, you can read about these updates by viewing our blog.