If you’ve made sales to the EU and find that the transactions are not being pulled into box 8 of your VAT return (Total value of all supplies of goods and related costs, excluding any VAT, from other EC member states) then you will need to enable the option to let you set on a per nominal basis what should be treated as EC sales.

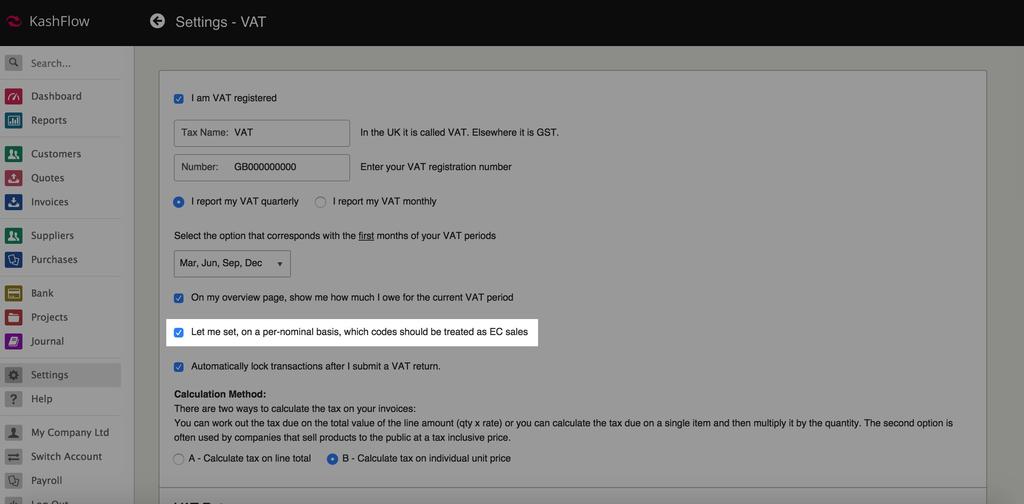

In order to do this please go to Settings | VAT settings | tick the option ‘Let me set, on a per-nominal basis, which codes should be treated as EC sales’ | Save settings

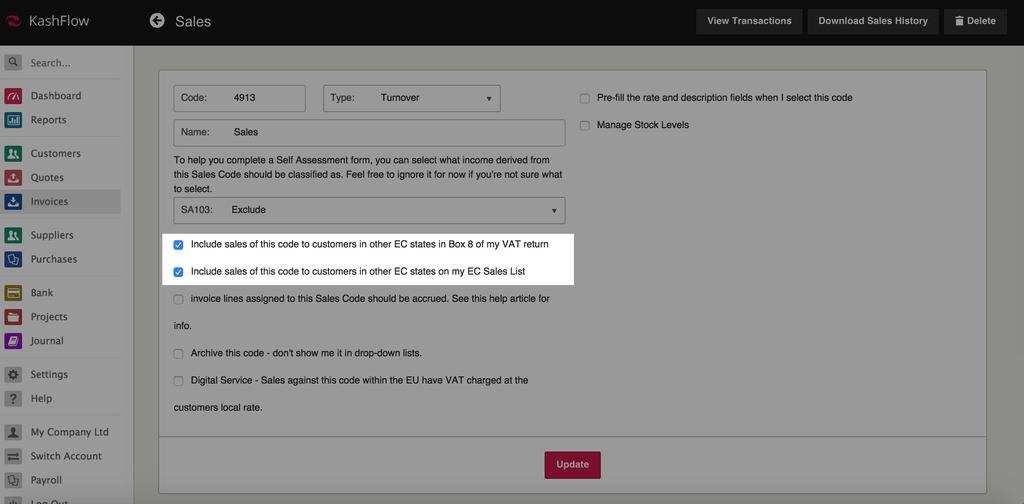

If you then go to Invoices | Sales Codes | click on your nominal code | You will then see 2 new options appear. One for ‘include sales of this code to customers in other EC states in Box 8 of my VAT return’ and a second for ‘Include sales of this code to customers in other EC states on my EC Sales List’. Simply tick the relevant options and then click update.

As long as your EC sales then have the correct nominal code then they will be handled correctly on your VAT returns.