Important note: Before importing Purchase Receipts you will need to create your suppliers, or import them in KashFlow.

Required Fields

The Suppliers import requires four critical fields;

- Supplier Code – this is the Suppliers unique identification code, the Supplier must already be in KashFlow – i.e. “CUST0001”

- Receipt Number – this is the Purchase Number that the Line Item will be applied to – it must be numbers only – i.e. “123”

- Receipt Date – this is the date the Purchase was issued – it must be in DD/MM/YYYY format – i.e. “01/01/2012”

- Due Date – this is the date the Purchase was/is due by– it must be in DD/MM/YYYY format – i.e. “01/02/2012”

Optional Fields

The other optional fields you can have are listed below;

- Supplier Reference – i.e. “ABC12345”

- Line Quantity – the quantity of Line Items – this must be a whole number – i.e. “5”

- Line Description – the Description of your purchased Line Item – i.e. “Laptop”

- Line Charge Type/Purchase Code – this is the Purchase Code of your Line Item, these can be found in your Chart of Accounts – i.e. “5009”

- Line Rate – this is the price of a single line item and must be a number with a maximum of two decimal places and not include the currency symbol – i.e. “5.50”

- Line VAT Amount – this is the amount of VAT that was charged on the Line Item – it should not include the currency symbol and be to a maximum of two decimal places – i.e. “0.50”

- Line VAT Rate – the rate of VAT in percent that was applied to this Line Item – this should be to a maximum of one decimal places and not include the percentage symbol – i.e. “17.5”

- N/A VAT – to set your VAT rate as N/A you need to enter negative 2 – i.e. “-2”

- Project Number – if you have Projects set up you can attach this Line Item to the Project by entering in the number here, this must already be set up in Projects in KashFlow – i.e. “1”

- Currency Code – this is the standardised code for the line item currency, if you are using a foreign currency it must already be set up in KashFlow – i.e. “USD”

- Exchange Rate – if you billed your Line Item in a foreign currency you can specify an exchange rate here, this must be a number to a maximum of four decimal places – i.e. “1.1234”

Uploading the template

To import

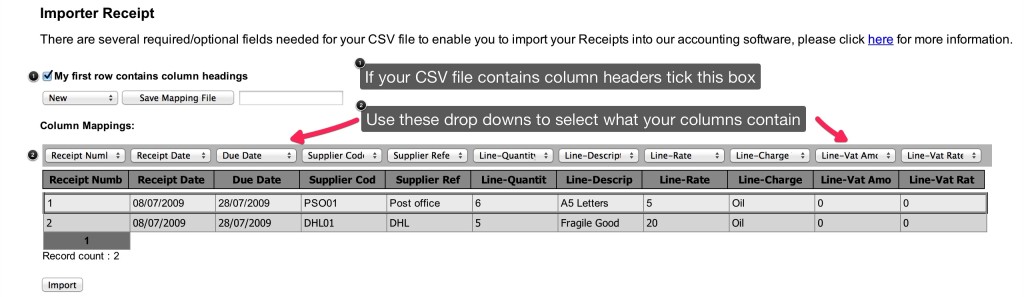

Settings > Import Data > Import CSV Files > Enter in your Username & Password (Please note if you have specified an alternative API Password you would need to use it here) > CSV > Receipt > Upload your file > Tick the box ‘ My first row contains column headings; if appropriate > Use the drop downs to map the file > Import

Please note, if the CSV file contains any special characters such as, ‘ ; ( ) {} & * £ $ “ ” <> ? / @ ~ # etc… Please remove as these may cause errors to the import process.