If you are wanting to enter your opening balances after moving from another accounting system, you would need to follow the steps on this knowledge base article which will give you all the information you need. However, if you are on the Cash Accounting scheme then you will also need to take into account the below information for this to work correctly when entering the opening balances for the Debtor and Creditor Control Accounts.

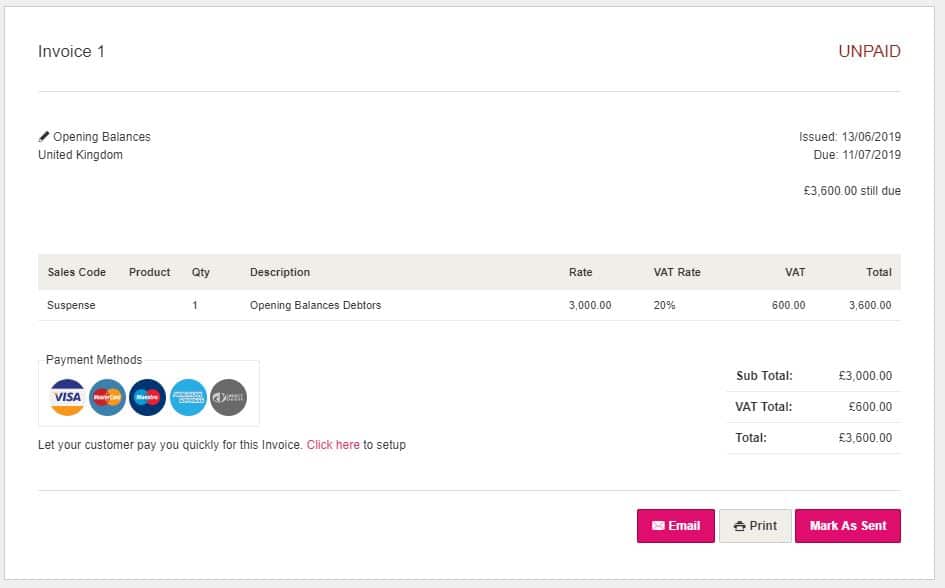

You will see on Step 3 of this article, that you need to create an invoice for the amount of the opening balance of your Debtor Control Account so that it populates the figure in the right nominal code.

As you are on Cash Accounting, you will need to make these adjustments:

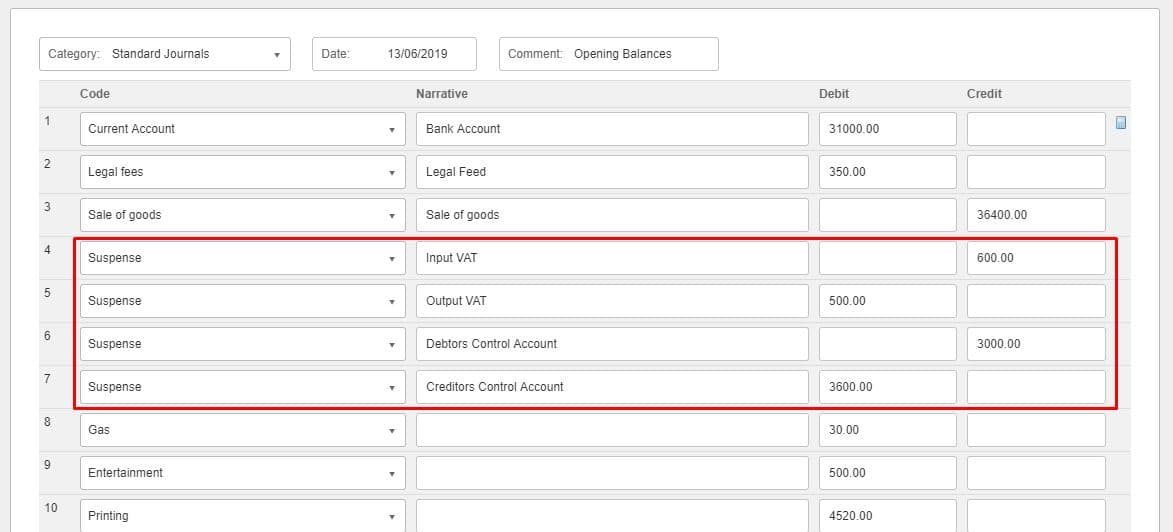

When you are entering the journal, you will need to code the “Input VAT” and “Output VAT” also the Suspense account (or nominal code used for your opening balances).

You will then need to go to the Customer record (either as a bulk customer record, or in each individual customer records) and create the invoice. You will need to post the invoice including the VAT amount.

You will need to go the same thing with the Supplier Opening Balances.

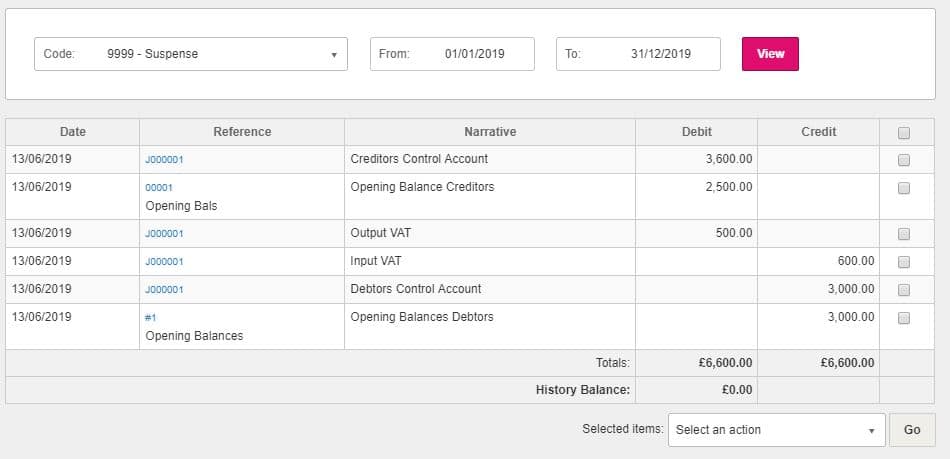

When viewing the Suspense Account detail by going to Reports> Nominal Reports you see that the Suspense account will have a end balance of zero as the invoice/purchase and journal entry will cancel each other out.

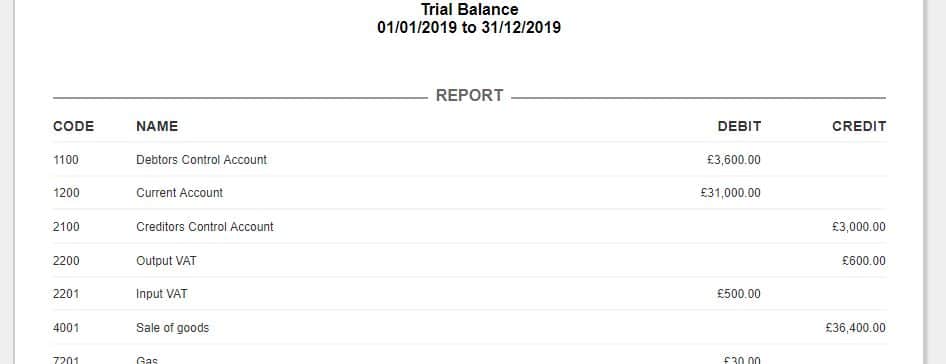

This is how your Trial balance will show once completed: