Overview

All businesses operating in the UK building and construction industry should check whether the new VAT domestic reverse charge for building and construction services (CIS reverse charge) will apply to them.

This anti-fraud measure is a major change to the way VAT is collected and it will affect customers and suppliers who receive or supply ‘specified services/supplies’ that are reported under the Construction Industry Scheme (CIS).

It comes into force from 1st March 2021.

When does the CIS reverse charge start?

The CIS reverse charge starts on 1st March 2021 and applies to all supplies with a VAT tax point date on or after that date.

The tax point date is usually the earlier of the date the supplier issues the VAT invoice or the date the supplier receives payment.

If the tax point date is before the 1st March 2021, current VAT rules apply.

You do not need to change part paid invoices as of the 1st March 2021.

What is the CIS reverse charge?

In summary, the CIS reverse charge is a major change to the way VAT is accounted for on the supply of ‘specified services and supplies.’

Under the CIS reverse charge, the customer receiving the ‘specified supplies or services’ will have to account for the VAT due to HMRC, instead of paying it to the supplier.

The CIS reverse charge only applies if the supplier and the customer are both registered for VAT in the UK and the supply is of ‘specified services or supplies’ that are reported under CIS.

If the CIS reverse charge relates to any part of a mixed supply (i.e. construction services supplied with other services in a single supply) the CIS reverse charge must be applied to the whole supply.

Where materials are supplied separately (i.e. not with services), they are not subject to the CIS reverse charge.

There are some exemptions, for example:

- The CIS reverse charge does not apply if there is just a supply of staff from an employment business who do not provide a construction service, i.e. they just provide staff to the customer and the customer controls them and tells them what to do.

- Where goods are supplied with zero-rated services, they (the goods and services) are not subject to the CIS reverse charge.

- The CIS reverse charge does not apply to consumers or final customers of building and construction services (“end users”) or VAT and CIS registered businesses that are connected or linked to end-users (“intermediary suppliers”). To be connected or linked to an end-user, intermediary suppliers must either:

- Share a relevant interest in the same land where the construction works are taking place; or

- Be part of the same corporate group or undertaking as defined in section 1161 of the Companies Act 2006.

Where the CIS reverse charge does not apply, VAT should be accounted for in the normal way.

What construction services does the CIS reverse charge apply to?

HMRC states that you must use the CIS reverse charge for the following services:

- Constructing, altering, repairing, extending, demolishing, or dismantling buildings or structures (whether permanent or not), including offshore installation services.

- Constructing, altering, repairing, extending, demolishing of any works forming, or planned to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks, and harbours, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defense.

- Installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure.

- Internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration.

- Painting or decorating the inside or the external surfaces of any building or structure.

- Services that form an integral part of, or are part of the preparation or completion of the services described above – including site clearance, earth-moving, excavation, tunneling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping, and the provision of roadways and other access works.

For more information, please visit: https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services#annexe1

What is exempt from the CIS reverse charge?

HMRC states the following examples of services where the CIS reverse charge should not be used, when supplied on their own:

- drilling for, or extracting, oil or natural gas

- extracting minerals (using underground or surface working) and tunnelling, boring, or construction of underground works, for this purpose

- manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site

- manufacturing components for heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems, or delivering any of these to site

- the professional work of architects or surveyors, or of building, engineering, interior or exterior decoration and landscape consultants

- making, installing and repairing art works such as sculptures, murals and other items that are purely artistic signwriting and erecting, installing and repairing signboards and advertisements

- installing seating, blinds and shutters

- installing security systems, including burglar alarms, closed circuit television and public address systems

For more information, please visit: https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services#annexe1

What to do if there is a change in circumstances that impact the CIS reverse charge treatment?

There may be contracts where a change in circumstances mean the CIS reverse charge treatment changes. If this occurs, the customer should notify the supplier (or vice versa) that the change has occurred, and the new treatment will apply from the point the circumstances change.

For example:

- a customer no longer retains an interest in the land concerned, or

- a property developer sells a partly completed building (sometimes called a sale at ‘golden brick’ stage) and carries on supplying the construction services to the new owner to complete the building.

In the above examples, the customer should notify the supplier that the end user exclusion no longer applies and charges for services in future would be subject to the CIS reverse charge.

The new treatment will apply from the point the customer’s circumstances change.

If this change happens during an invoice period (where there would be one invoice including both reverse charge and normal VAT rules), the supplier can opt to change to the new treatment for the entire invoice period or wait until the next invoice period before changing to the new treatment.

How does the CIS reverse charge affect the supplier?

Under normal rules:

- The supplier charges VAT to the customer, the customer pays the VAT to the supplier and the supplier pays the VAT to HMRC.

Under new rules (where CIS reverse charge applies):

- VAT is not charged to or collected from the customer and is not paid across to HMRC by the supplier.

- The VAT charge or rate that would have applied should be shown on the invoice so that the customer can account for it but should not be included in the amount payable.

- The supplier must inform the customer that the CIS reverse charge applies and must ensure the customer knows they must account for it. We suggest a simple statement on the invoice such as, “Reverse charge: customer to pay VAT to HMRC.”

- Suppliers should check the VAT and CIS status of their customers for each contract and keep a record of such check. They should also keep a record of VAT numbers and CIS registrations of all customers affected by the CIS reverse charge so that they can provide them to HMRC if requested. We also advise that the check both the VAT numbers and CIS registration numbers provided.

- VAT numbers can be checked:

- CIS registration checks – You should request from customers and retain a copy of their CIS verification. Also, if you are registered for CIS as a contractor, HMRC recommends you use the CIS verification system:

- The key adjustments to the way you complete the VAT return where the CIS reverse charge applies are:

- Do not include a VAT charge in Box 1 of the VAT return (as no charge is being made)

- Do show the net value of the supply, excluding VAT charge, in box 6 of VAT return

Advice:

- If supplier finds that as a result of the CIS reverse charge they end up becoming a repayment trader, i.e. they regularly submit repayment VAT returns, they should consider opting to move to monthly VAT returns (instead of quarterly) to assist with cashflow.

How does the CIS reverse charge affect the customer?

Under normal rules:

- The customer receives an invoice from the supplier containing an element of VAT at standard (20%) or reduced rate (5%), the customer enters the invoice into their bookkeeping software, pays VAT to supplier and recovers VAT from HMRC.

Under new rules (where CIS reverse charge applies):

- The customer receives an invoice from the supplier that does not contain VAT but does contain a note stating what the VAT rate / charge should be.

- The customer accounts for the VAT, effectively paying VAT directly to HMRC by including it on their VAT return as a sale (new under the CIS reverse charge) and purchase (in same way as normal VAT but in this instance the VAT is not included on the invoice). The sale element increases the VAT due / reduces the VAT refund, and offsets the purchase element.

- No VAT rates are changed.

- The VAT return entry requirements under the CIS reverse charge are:

- Do include the VAT charge in Box 1 as if the supply were a sale

- Do show the VAT reclaimed in Box 4 of the VAT return

- Do not show the supply in Box 6

- Do show the net value of the purchase, excluding VAT charge, in Box 7

Accounting for the CIS reverse charge within Kashflow

Configuring CIS reverse charge in KashFlow

First, you must ensure that the correct CIS options are applied to your company settings.

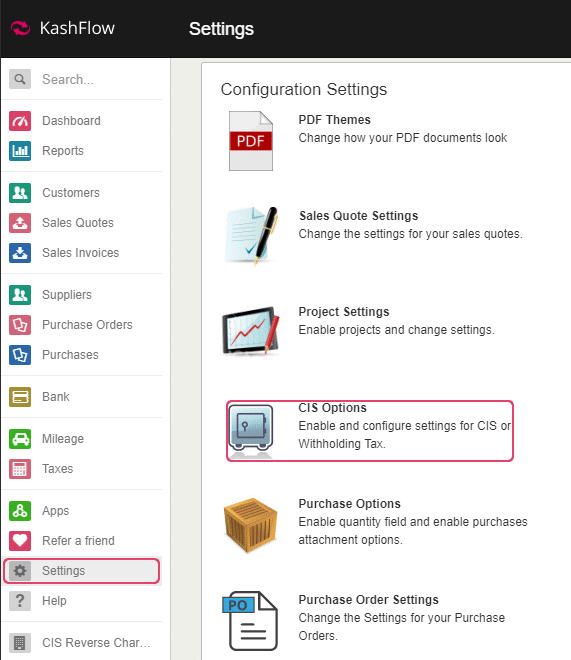

Go to Settings > CIS Options

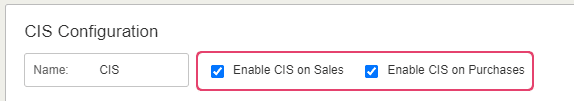

Tick the option(s) Enable CIS on Sales and/or Enable CIS on Purchases (as appropriate for your business) and click Save Changes

Applying CIS reverse charge on sales invoices

First, you must ensure that the correct CIS options are applied to your customer settings.

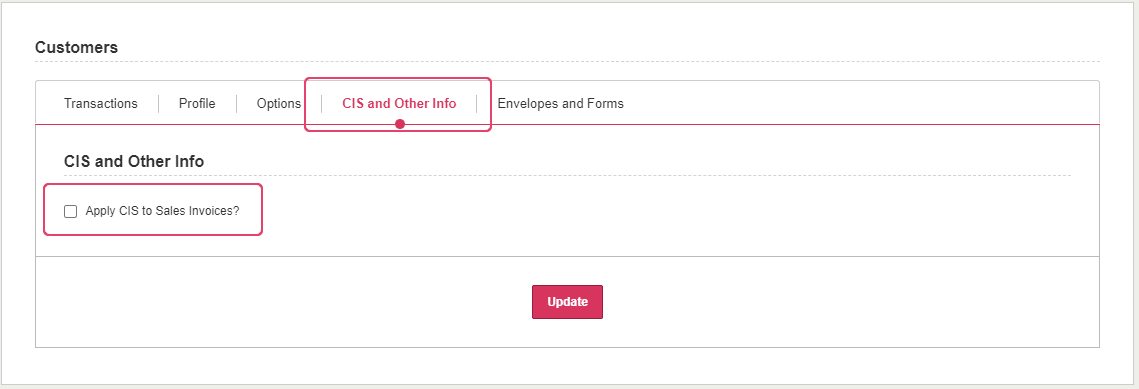

Go to Customers > Select appropriate customer from the list > CIS and Other Info

Tick the option Apply CIS to Sales Invoices (if it has not already been ticked)

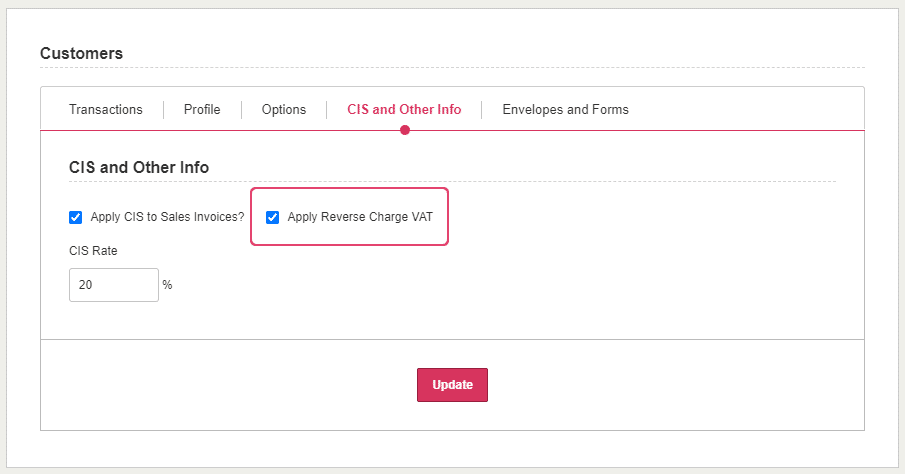

You will then see the option Apply Reverse Charge VAT. Tick this option to include VAT reverse charge on sales invoices raised for this customer.

Please Note: You will only be able to apply these changes if the customer is VAT registered in UK (i.e. customer is set as VAT registered / based in home country in the Options screen whilst you, the KashFlow user, are VAT registered in the UK).

Click Update to save the changes.

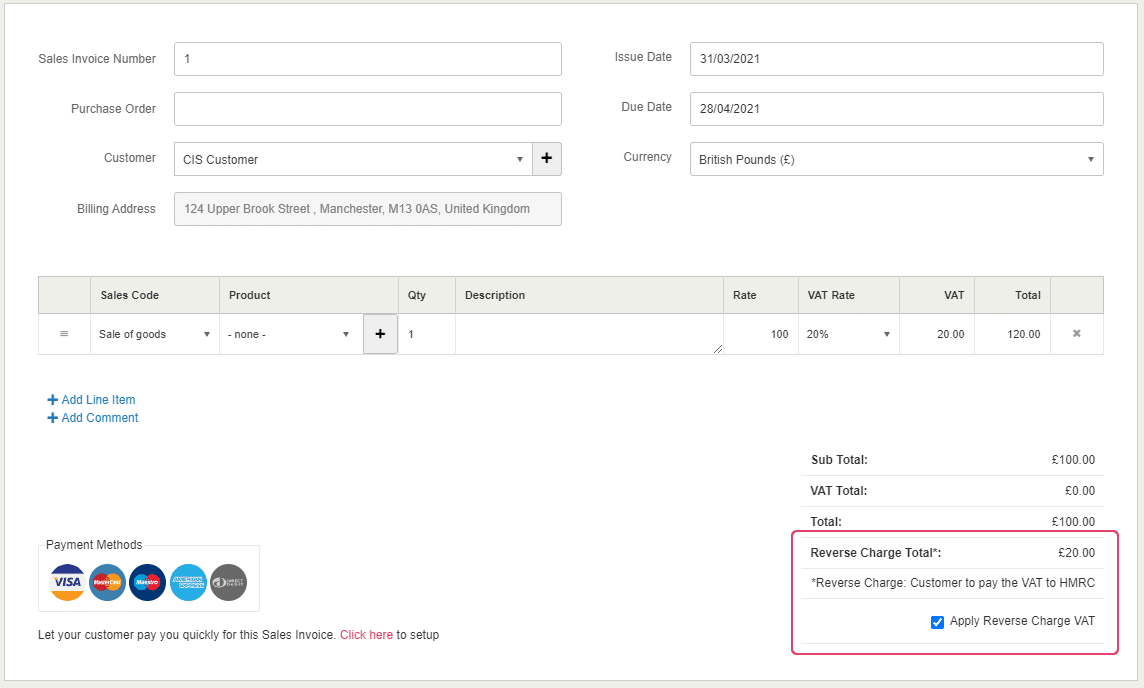

When you now create a new sales invoice for this customer, if it is dated after 1st March 2021, the VAT reverse charge will be automatically added to the invoice:

Please Note: You are able to apply reverse charge VAT at an invoice level. If reverse charge VAT is selected against the customer in CIS options, then any invoice created against that customer will have the setting enabled by default, however, you can tick/untick the Apply Reverse Charge VAT option on the Invoice itself. The same applies if the tickbox is unticked by default.

Applying CIS reverse charge on purchases

First, you must ensure that the correct CIS options are applied to your supplier settings.

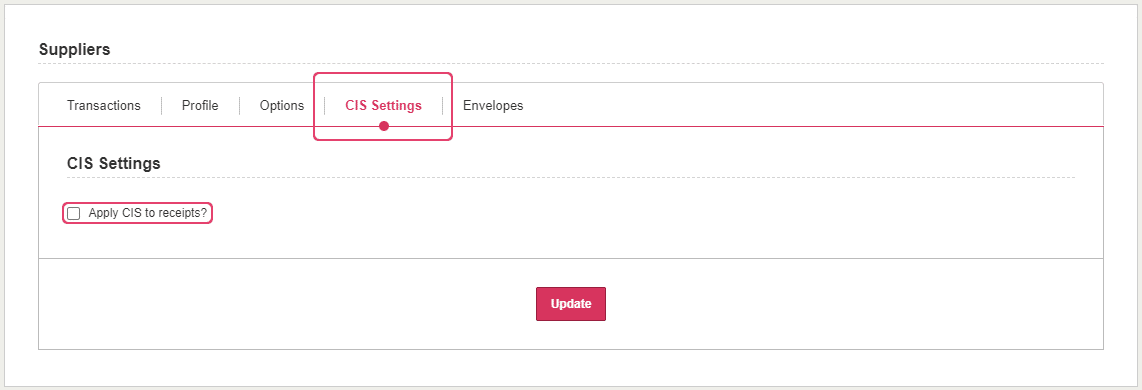

Go to Suppliers > Select the appropriate supplier from the list > CIS Settings

Tick the option Apply CIS to receipts? (if it has not already been ticked)

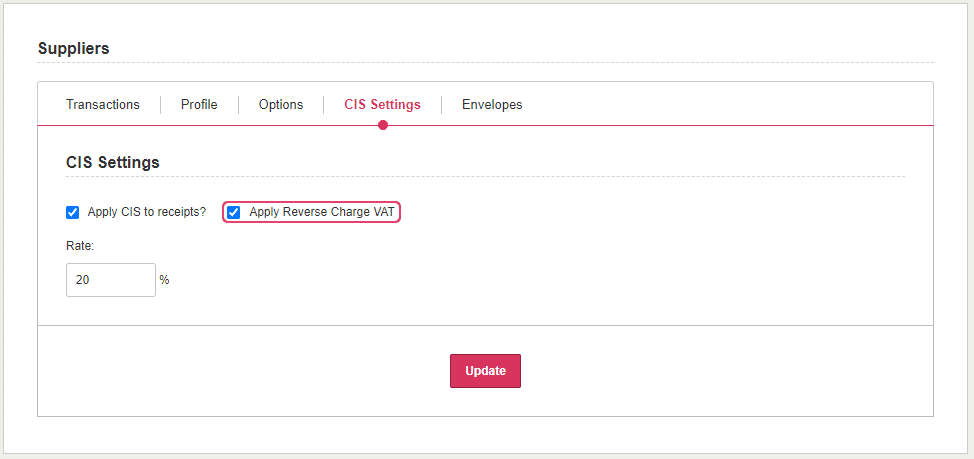

You will then see the option Apply Reverse Charge VAT. Tick this option to include VAT reverse charge on purchases raised for this customer.

Please Note: You will only be able to apply these changes if the supplier is VAT registered in UK (i.e. supplier is set as VAT registered / based in home country in the Options screen whilst you, the KashFlow user, are VAT registered in the UK).

Click Update to save the changes.

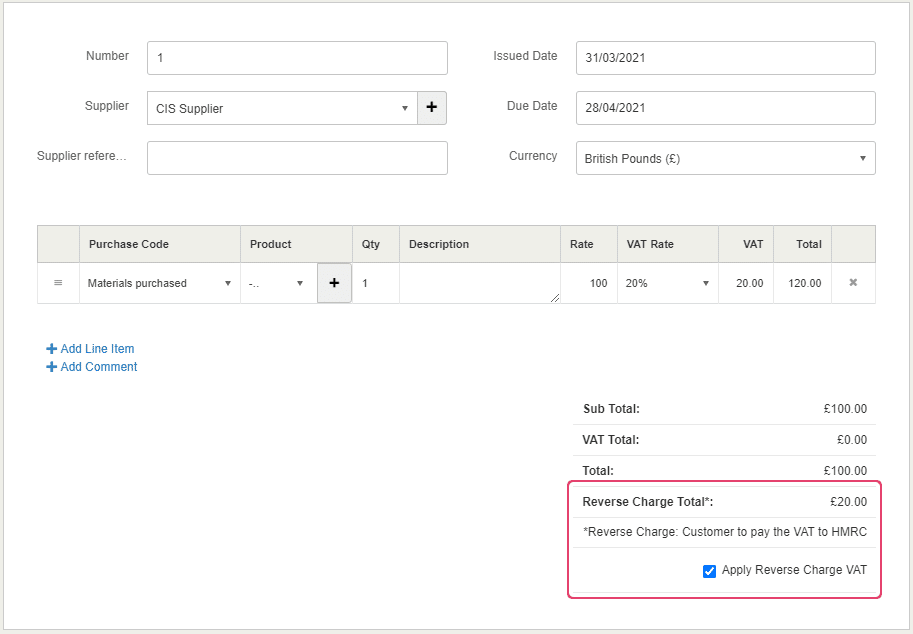

When you now create a new purchase for this supplier, if it is dated after 1st March 2021, the VAT reverse charge will be automatically added:

Please Note: You are able to apply reverse charge VAT at a purchase level. If reverse charge VAT is selected against the supplier in CIS options, then any invoice created against that Customer will have the setting enabled by default, however, the user can tick/untick the Apply Reverse Charge VAT option on the purchase itself. The same applies if the tickbox is unticked by default.